CASE STUDIES

These detailed customer journeys illustrate the depth and focus of CDER Group’s intelligence-led processes, tailored and optimised for each individual to help ensure a fairer resolution.

Case Study 4 | Vulnerability

As part of our new Fairness Charter, which underpins all CDER Group operations, our Vulnerability Strategy ensures timely identification and tailored support for customers needing extra assistance. This process flow illustrates how our personalised approach and close partnerships with the advice sector helped one customer clear their burden of debt.

Case Study 5 | Vulnerability

Our Enforcement Agents undertake undertake advanced training to help them identify potential vulnerability. This process flow illustrates the close liaison between our agents and Welfare Team, and how we coordinated support for one customer who, through a period of ill health, was unable to pay a growing number of debts.

Case Study 6 | New Occupier

CDER Group’s early trace and validation processes minimise the number of letters, call or visits for addresses where the debtor is no longer resident. New address details are always verified and evidenced allowing us to quickly continue action at a new address, or update our clients allowing the issue of a new warrant or liability order.

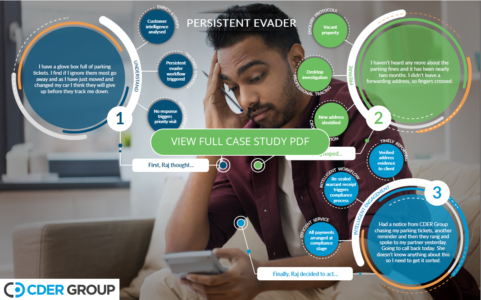

Case Study 7 | Persistent Evader

Our Edge platform’s unique debtor-centric architecture provides us with a “single customer view” which, along with our robust trace and validation processes, ensure we identify and access the most current information to locate customers incurring multiple penalties and avoiding payment. Our Persistent Evader processes also include solutions to help clients minimise the costs of debt registration.

Case Study 8 | Tracing

CDER Group’s collection performance on those cases returned as unsuccessful by other service providers is testament to the effectiveness of our trace and collection operations. This process flow illustrates how our advanced commercial tracing capabilities led to the location and successful resolution of a large and long-standing NNDR debt.